Corporate Governance

The rules and regulations of Corporate Governance are laid out in numerous Autoneum documents, in particular the Articles of Association*, the Organizational Regulations* and the Board Committee Regulations. The content and structure of this report conform to the Directive Corporate Governance (DCG) and the related Guideline published by the SIX Swiss Exchange. Unless stated otherwise, the data pertains to December 31, 2020. Some information will be updated regularly on www.autoneum.com/investor-relations. For some information readers are referred to the financial section of this Annual Report. The Remuneration Report can be found here.

1 Group structure and shareholders

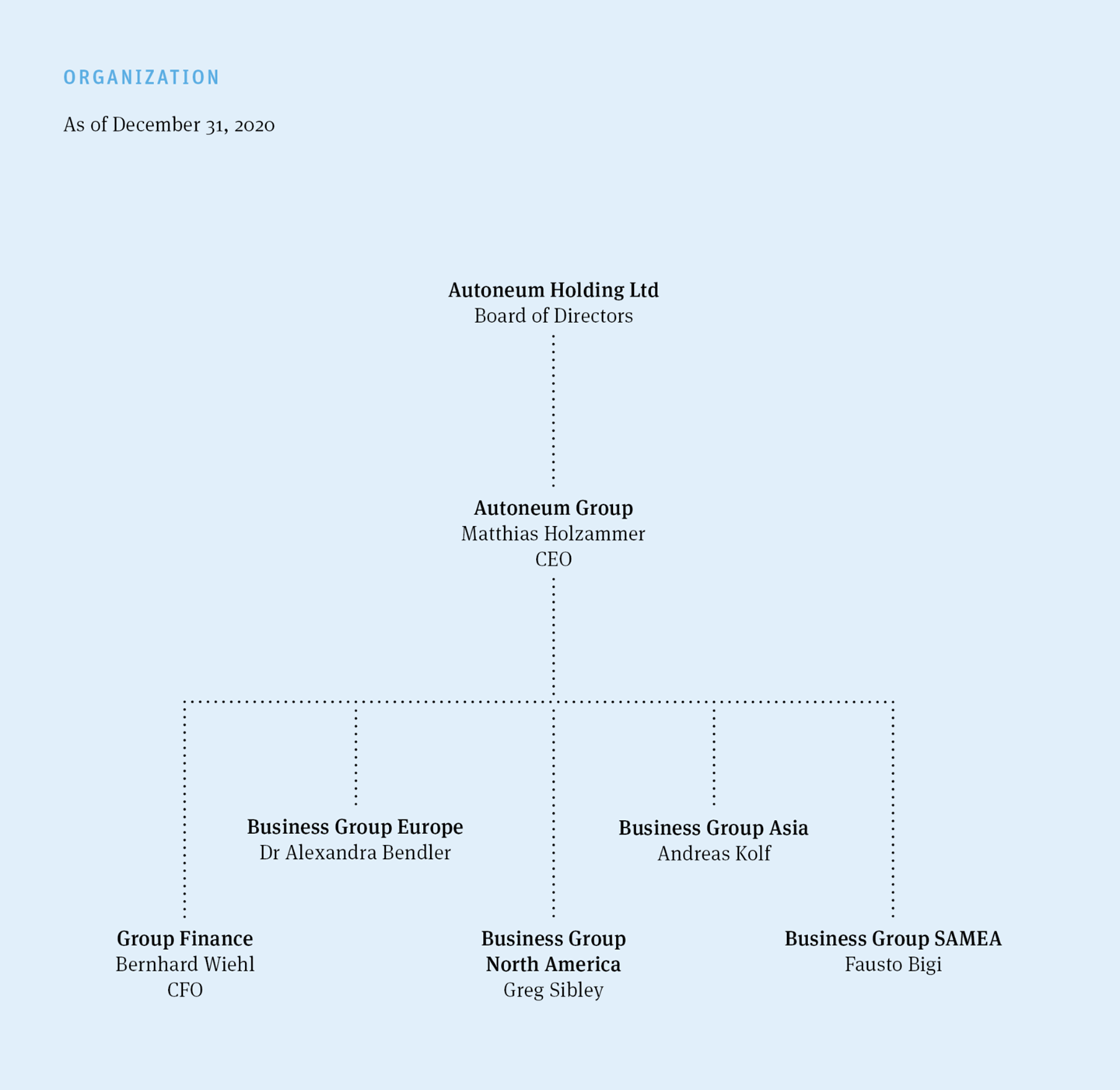

Group structure

Autoneum Holding Ltd is a company incorporated under Swiss law, with its registered offices in Winterthur. Its shares are listed on the SIX Swiss Exchange (securities code 12748036, ISIN CH0127480363, symbol AUTN). Market capitalization as of December 31, 2020 was CHF 749.6 million.

Autoneum Group consists of the four Business Groups Europe, North America, Asia and SAMEA (South America, Middle East and Africa), the Group Finance department and those corporate functions that report directly to the CEO. It includes all companies controlled by Autoneum Holding Ltd. Within the framework of internal regulations, the Business Groups are responsible for the profitability of each individual company with the exception of those business activities and companies that report directly to the CEO. Each Business Group has been established for a clearly defined and demarcated specific market region. Each of these Business Groups conducts its business within the framework of the Organizational Regulations* and under the leadership of the Business Group Head, who reports directly to the CEO of the Autoneum Group. The segment reporting information can be found under note 4.

The Group Finance department and those corporate functions that report directly to the CEO support the CEO, the Business Group Heads and the Board of Directors in their management and supervisory functions, and are responsible for the activities outside the Business Groups, such as management of holding companies and pension funds. Subsidiary companies are founded based on legal, business and financial considerations. One person (Head of Legal Unit) is appointed for each company and is responsible for local financial management as well as for compliance with national laws and regulations and internal guidelines. Companies with participation of further shareholders are principally managed as described above, however taking into consideration the respective agreements.

42 companies worldwide belonged to the Autoneum Group as of December 31, 2020. An overview on subsidiaries comprising the names, domiciles and share capital of the subsidiaries and the voting rights held by the Autoneum Group can be found under note 35. The management organization of the Autoneum Group is independent of the legal structure of the Group and the individual companies.

Significant shareholders

As of December 31, 2020 Autoneum was aware of the following shareholders with 3% or more of all voting rights in the Company:

- Artemis Beteiligungen I Ltd, Hergiswil, Switzerland; Centinox Holding Ltd, Hergiswil, Switzerland; and Michael Pieper, Hergiswil, Switzerland; 21.3%

- PCS Holding Ltd, Frauenfeld, Switzerland; and Peter Spuhler, Warth-Weiningen, Switzerland; 16.17%

- Martin and Rosmarie Ebner via BZ Bank Limited, Wilen, Switzerland; 3.1%

All notifications of shareholders with 3% or more of all voting rights in the Company have been reported to the Disclosure Office of the SIX Swiss Exchange in accordance with Art. 120 of the Financial Market Infrastructure Act (FMIA) and published via its electronic publication platform on www.ser-ag.com/en/resources/notifications-market-participants/significant-shareholders.html#/, where further details can also be found. As of December 31, 2020 Autoneum Holding Ltd held 0.72% of the share capital (33 803 shares).

Cross-holdings

The Company has no information about cross-holdings of capital or voting shares exceeding the limit of 5% on both sides.